Learn how to invest.

The simple things you need to know before you start.

-

Why do people invest?

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

-

What can I invest in?

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

-

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

Why people invest

[Sub section heading]

Investing means allocating resources, such as money, time or effort, to gain some sort of profit or advantage..

In other words, the goal of investing is to get out more than you put in.

People invest for a variety of reasons, but the ultimate aim is to grow wealth. Common reasons for investing include;

Planning for retirement

Financial independence

Earning additional income

Reaching a financial goal

Beating inflation

Tax efficiency

In reality, for most people it’s a combination of multiple reasons that lead them to invest.

Investing vs Saving

It’s easy to think of ‘saving’ as investing. While the two often go hand in hand, they also work quite differently.

On a practical level, saving involves putting aside money today for use in the future. It’s what economists describe as ‘forgone consumption’. In other words, rather than spending all your money, you tip some into a savings account for another time.

Savings is a sensible starting point in investing because it provides the funds you need to purchase a range of different assets. However investing goes one step further, helping you achieve personal goals with three significant benefits.

The potential for healthy long term returns

While saving means setting aside part of today’s money for tomorrow, investing means putting your money to work to potentially earn a better return over the longer term. Different classes of investment assets – cash, fixed interest, property and shares – typically generate different levels of return (which is relative to the risk of the investment).

What can I invest in?

[Sub section heading]

The following text is placeholder known as “lorem ipsum,” which is scrambled Latin used by designers to mimic real copy. Lorem ipsum dolor sit amet nullam vel ultricies metus, at tincidunt arcu.

[Sub section heading]

Morbi vestibulum, ligula ut efficitur mollis, mi massa accumsan justo, accumsan auctor orci lectus ac ipsum. Proin porta nisl sem, ac suscipit lorem dignissim et. Curabitur euismod nec augue vitae dictum. Nam mattis, massa quis consequat molestie, erat justo vulputate tortor, a sollicitudin turpis felis eget risus.

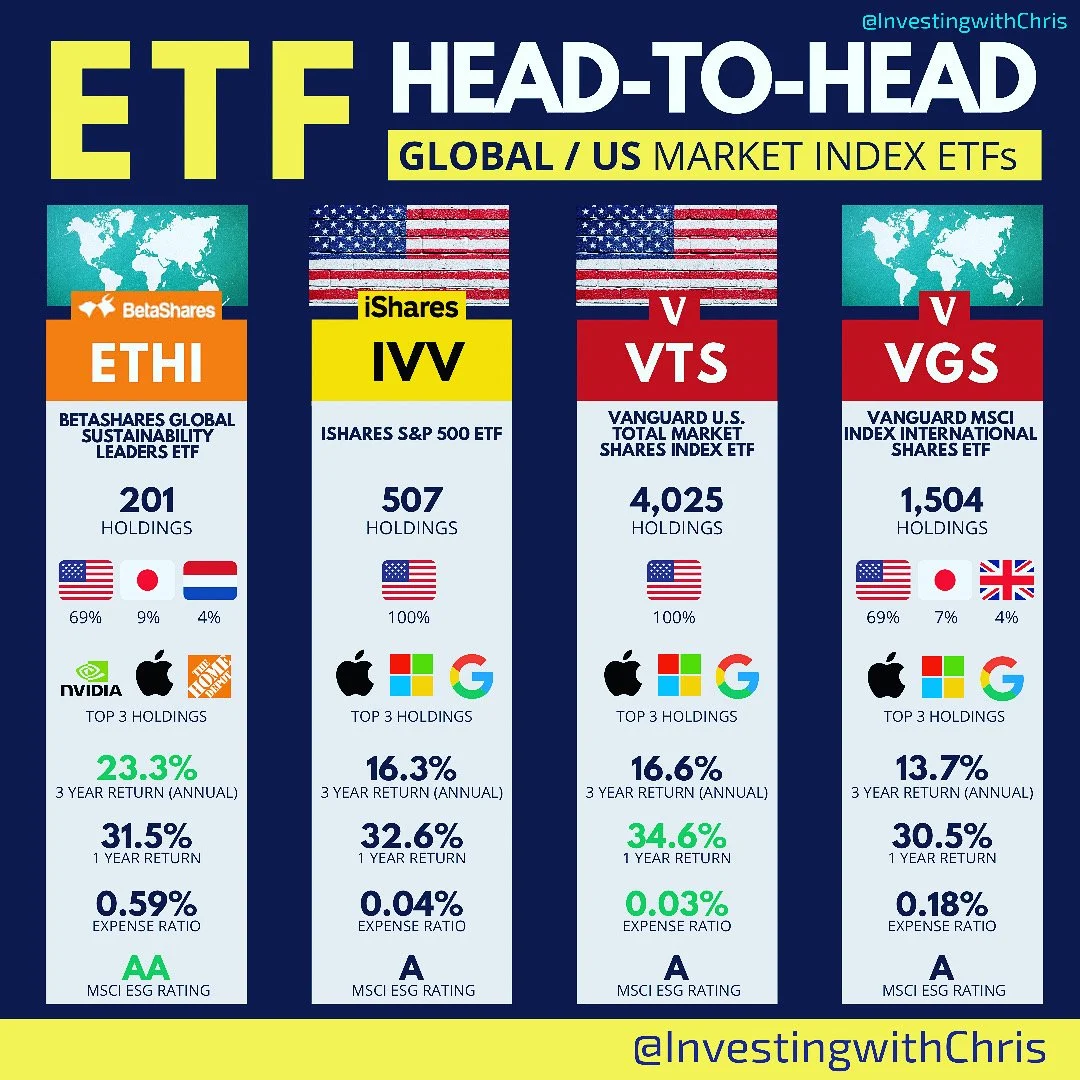

Why are ETFs so popular?

[Sub section heading]

The simplest way to think about an ETF is like a basket of shares. The basket can be big and contain hundreds or thousands of different companies. Or it could be small and contain as little as 10 companies. Either way, it’s like getting a little bit of a lot of different companies, all bundled together.

[Sub section heading]

Morbi vestibulum, ligula ut efficitur mollis, mi massa accumsan justo, accumsan auctor orci lectus ac ipsum. Proin porta nisl sem, ac suscipit lorem dignissim et. Curabitur euismod nec augue vitae dictum. Nam mattis, massa quis consequat molestie, erat justo vulputate tortor, a sollicitudin turpis felis eget risus.

Where can I invest?

[Sub section heading]

The following text is placeholder known as “lorem ipsum,” which is scrambled Latin used by designers to mimic real copy. Lorem ipsum dolor sit amet nullam vel ultricies metus, at tincidunt arcu.

[Sub section heading]

Morbi vestibulum, ligula ut efficitur mollis, mi massa accumsan justo, accumsan auctor orci lectus ac ipsum. Proin porta nisl sem, ac suscipit lorem dignissim et. Curabitur euismod nec augue vitae dictum. Nam mattis, massa quis consequat molestie, erat justo vulputate tortor, a sollicitudin turpis felis eget risus.